Different types of financing may become available when an innovative project is born, coming from the public sector, banks or private sources. Determining which of these forms is appropriate and sustainable for your company depends on a number of factors, the most important of which are:

- the development phase of the project;

- the size of the company that wants to innovate;

- the amount of money needed;

- the co-financing capacity of the holding;

- willingness to share results;

- the opening of new funding partners;

- the risk appetite of private investors.

The sources to finance your innovation plan can be multiple and come from various public or private entities. Below is a brief description of the characteristics of each:

- entrepreneurs: they generally provide all the financing they are able to offer, as well as non-financial contributions, such as their own work, or real estate and personal equipment put at the service of the enterprise;

- friends and family: they are a useful and often disinterested help, but they can generally invest limited resources;

- informal investors, or Business Angel: are people who own capital to invest in innovative projects that they consider most promising;

- Venture Capital: the provision of venture capital by an investor to finance the start-up or growth of an activity in sectors with high development potential. Often the same name is given to funds created specifically, while the entities that carry out these operations are called "Venture Capitalists", is addressed to companies with investment plans above 250,000 euros, which present high opportunities for growth and profit;

- banks: the role of banks is to provide the usual banking services, such as loans or loan guarantees, ranging from a few thousand to millions of euros;

- public sector: public sector programmes and calls for proposals to support research. The funds may be regional, national and European. It also indicates the possibility of accessing the European Investment Fund (loan guarantees and investments in risk funds).

As far as public funding for innovation is concerned, it comes from the Community and is divided into:

- funds managed directly by the European Commission and funds managed by the Member States through their central (national) and peripheral (regional or local) administrations;

- in the case of directly managed financing, it is the European Commission, based in Brussels, or its delegated agency, which provides the funds directly to end-users, through participation in the notices published periodically in the Official Journal.

In the case of European financing under indirect management, the financial resources of the EU budget are transferred to the Member States, in particular to the regions, which, on the basis of the operational programmes, use them and allocate them to the final beneficiaries.

The Region, through Sardegna Ricerche promotes and supports the birth and growth of innovative companies.

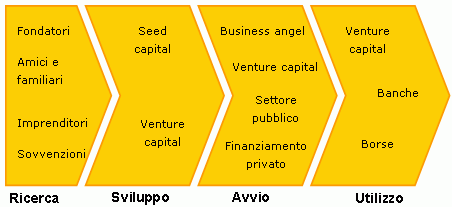

Finally, it should be stressed that at each stage of the innovation plan some sources of funding are more suitable than others, as can be easily seen from the figure below.

For more information, please consult the EU portal and the website of Sardegna Ricerche.